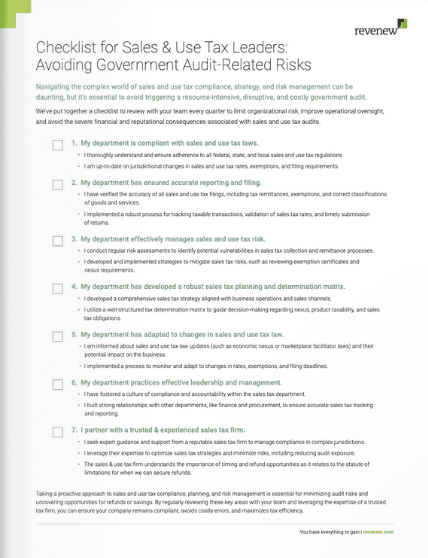

Avoiding Government Audit-Related Risks

Sales and use tax compliance is complex, but our checklist helps leaders stay proactive, reduce risks, and ensure compliance.

Most businesses don’t have the resources to sift through every single transaction. Instead, they just flag 10-20% of transactions for review and rely on a basic tax determination matrix to find recovery areas. The problem? A lot slips through the cracks, and companies end up paying more than they need to.

While income tax gets all the attention at the board level, sales tax is quietly paid month after month without much scrutiny. This blind spot makes it a prime area for recovery—and we’ve delivered tens of millions of dollars in refunds for our clients.

Tax codes are complicated and frequently change—a challenge for any in-house staff balancing other large tax initiatives. And if your business operates across multiple states, staying compliant with varying sales tax laws can be an added burden. Our sales and use tax consulting team includes CPAs and executives who’ve worked as state tax auditors. They know the tax codes inside and out, and they get the job done without taking up your valuable time.

Like it or not, your time is limited when filing for sales and use tax recovery, and any delay can result in those potential refunds being lost forever. Revenew’s sales and use tax consulting team is comprised of data mining experts who can find more opportunities and overpayments in less time. Whether minor errors or large-scale issues, we work efficiently to pinpoint where you’ve overpaid so you can recover those funds quickly.

Are you worried sales tax recovery services might not pay off for you? Don’t be. We’ve identified an eligible refund for every one of our clients. And because our recovery fees are contingency-based, no budgeting is required on your end. We don’t charge you for our percentage until you have your full refund in hand.

Our Sales Tax & Use Recovery team identified nearly $34 million in available refunds across eight US states for a multinational food manufacturing company. Read the case study here.

Avoiding Government Audit-Related Risks

Sales and use tax compliance is complex, but our checklist helps leaders stay proactive, reduce risks, and ensure compliance.