Case Studies

The dollars Revenew recovered from corrected errors...

Learn more

Mining company resolves billing disputes and achieves...

Learn more

Power producer recovers $3M and strengthens supplier...

Learn more

Global energy giant achieves $38.6 million in cumulative...

Learn more

Top-ranked U.S. research university avoids $3.8+ million in...

Learn more

Private medical device company prevents $185 million...

Learn more

Oil and gas operator unlocks $9 million in total refunds,...

Learn more

Mid-sized oil and gas operator saves $500K while avoiding...

Learn more

Our Sales Tax & Use Recovery team identified a total of $6.6 million in recoveries for a Florida utilities company across two engagements

Learn more

A pilot program for a multinational pharmaceutical company uncovered $1.2 million in recoverable funds through a thorough contract compliance review.

Learn more

Our Performance Improvement team identified over $1 million in six months.

Learn more

Our Sales Tax & Use Recovery team identified nearly $40 million in available refunds.

Learn more

Large Texas oil and gas operator recovers $12M in marketing costs with severance tax expertise.

Learn more

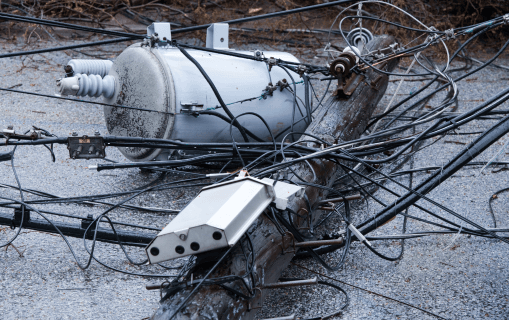

Revenew’s rapid response delivered $2.29 million in net savings following a plant disaster.

Learn more

Millions recovered for E&P company in less than 2 months.

Learn more

Final Settlement Statement Review recovered millions for one client.

Learn more

Exposure to risk minimized and over $2.5 million recovered.

Learn more

Closing loophole yielded $1 million.

Learn more

Hard-dollar savings of $3.28 million prevented/recovered.

Learn more

PO/Non-PO spend balance of 85%-15% achieved.

Learn more

Invoice review during and after storm nets $272.9 million.

Learn more

$228 million in savings delivered.

Learn more

Massive data backlog eliminated in just 30 days.

Learn more

Tax recoveries/savings averaged 400% ROI over three years.

Learn more

Contract language update saved over $250,000.

Learn moreeBooks & White Papers

From Raw Materials to Finished Product: Governing Cost,...

Learn more

Industrial Manufacturing Supplier Oversight Checklist

Learn more

Pharmaceutical Supplier Risk Self-Assessment Tool

Learn more

Value Maximization Checklist for Pharmaceutical Supplier...

Learn more

Maximizing Value in Pharmaceutical Supplier Contracts: A...

Learn more

Beyond Automation: Why Having a “Human in the Loop” is...

Learn more

Preparing for the Storm—Before It Has a Name: Disaster...

Learn more

Transformative Trends Shaping the Mining Industry: Critical...

Learn more

Navigating Auditing Headwinds in Mining: The Crucial Role...

Learn more

The Mining Auditor’s Guide: 5 Tips for Effective Vendor...

Learn more

Best Practices for MRO Contracts

Learn more

Checklist for Sales & Use Tax Leaders: Avoiding Government...

Learn more

The rise of e-invoicing and the unknown toll it takes on your company’s finances

Learn more

Energy Industry Vendor Audit Trends Report

Learn more

5 insider tips that will revolutionize your next vendor audit.

Learn more

More than $3 million recovered in just one year.

Learn more

Maximizing value in supply chain management.

Learn moreArticles

When Procurement, Operations, AP, and Finance See Different Versions of the Same Spend

Read more

When ‘Flexible’ Supplier Terms Become a Cost Liability in Industrial Manufacturing

Read more

Independent Validation Where It Matters Most: Eliminating Cost Leakage in Industrial Manufacturing Logistics

Read more

When Multi-Tier Supplier Networks Obscure True Cost Exposure

Read more

Where Cost Leakage Hides in $1B+ Data Center Builds (And Why It’s Rarely in the Budget)

Read more

Winter Storm Response: The First 48 Hours That Define Your Financial Outcomes

Read more

AI for Indirect Tax — What’s Real, What’s Noise, and What’s Next

Read more

Scaling with Confidence: Building a Use Tax System that Protects Growth

Read more

The Cost of Compliance: How Pharma Supply Chains Can Optimize Supplier Relationships

Read more

Proactive Supplier Management in Pharmaceuticals: An Expert Dialogue

Read more

Navigating Sales Tax on Digital Products: What Tax Leaders at Large Organizations Need to Know

Read more

Severance Tax Isn’t General Tax: Why Specialized Knowledge is Crucial

Read more

The 48-Hour Rule: How Quick Response Can Make or Break Your Disaster Recovery

Read more

The Importance of Supplier Audits in the Complex Mining Sector

Read more

Navigating the Minefield: Risks and Expenditures in the Modern Mining Industry

Read more

2024 Severance Tax Legislation Recap & What It Means for Your Business

Read more

Tax Director Exposes Company to a Government Audit

Read more

Free Webinar: Internal Audit's Role in Emergency Preparedness and Response

Read more

Proven Tactics for Extracting a Full Severance Tax Refund

Read more

Navigating the Tightrope: Balancing Cost and Risk in Supply Chain Optimization

Read more

5 Questions to Ask When Vetting a Third-Party Auditing Firm

Read moreOur programs contain costs, recover profits, and drive efficiencies – across organizations.